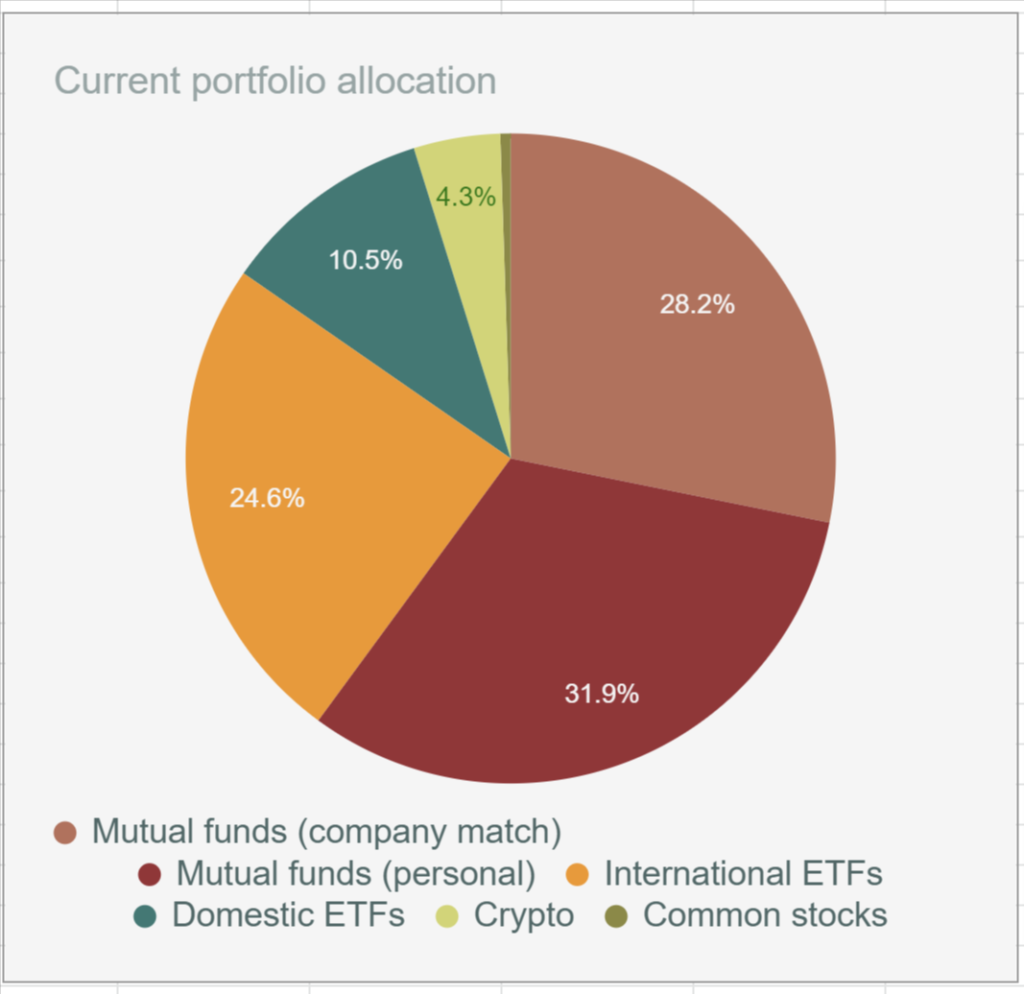

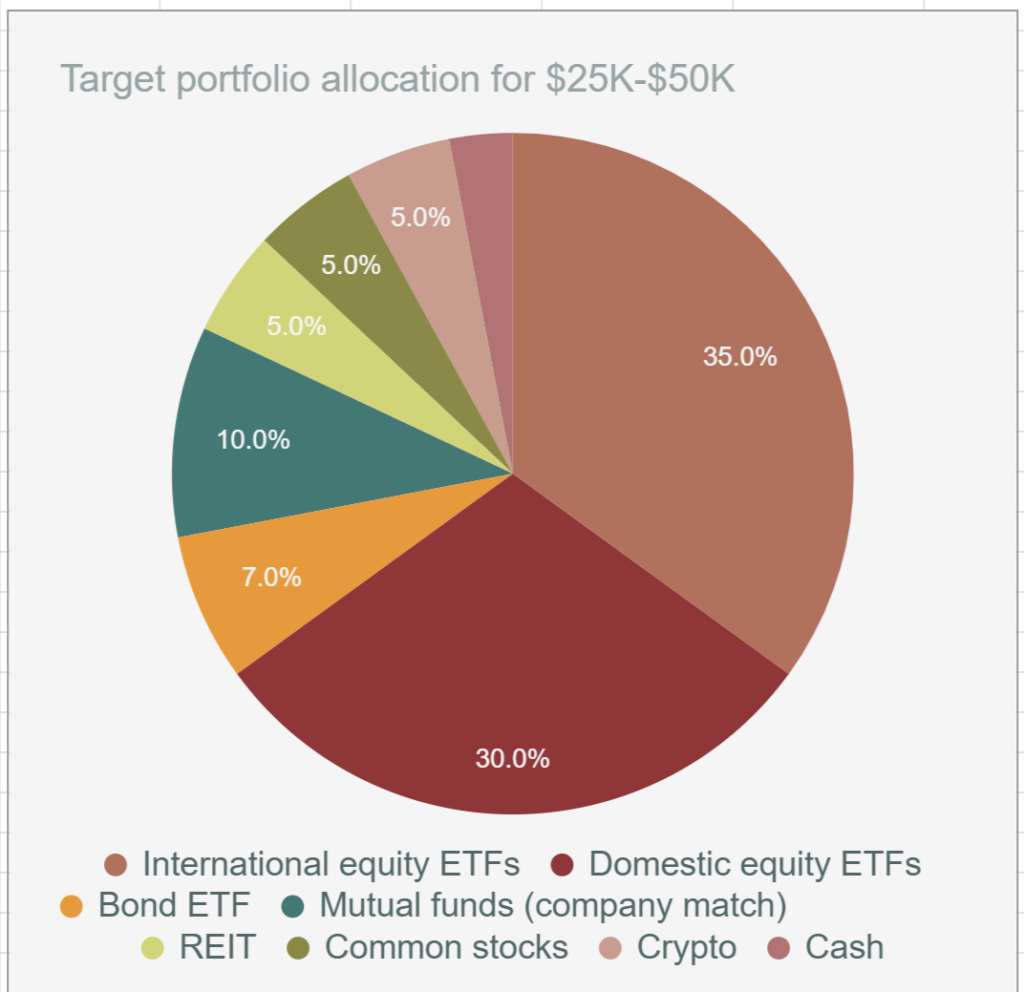

I’m currently creating my target allocation plan and I’m realizing how helpful these plans are to keep you on track. For example, in my head, I thought the vast majority of my investments were in ETFs, but when I look at the actual pie chart on paper, NOPE! Super wrong. It turns out that right now, only about 35% of my portfolio is in ETFs. Wow, that’s a big difference. It’s clear to me how much it helps to have things written down objectively.

So why did I have such a vastly different idea in my head that what’s actually happening in my portfolio? I’m trying to keep my portfolio ETF-heavy, so it was surprising to see how much of my portfolio was in mutual funds. (Side note, I am aiming to get rid of all the mutual funds I can asap.) Now, I obviously knew I had mutual funds at my bank and through my work plan, but somehow (maybe because they were automated) I didn’t focus on those and didn’t consciously realize their overall position relative to my other investments. Mentally, I simply focused on my ETF position since I add to it monthly and just assumed that was the bulk of my portfolio.

This type of bird’s eye view is a big reason for asset allocation plans. You want a way to objectively see your investments instead of relying on your memory or your mental math.

Seeing my overall portfolio in this way has lit a fire under me to sell my personal mutual funds and transfer that money to my self-managed brokerage. I can’t do anything about the mutual funds through my work, but I’m investing the lowest possible amount I need to in order to get the full match.

Look at me, rebalancing a portfolio when I barely knew was a few months ago 😉

Happy investing,

Squirre